2267

2267

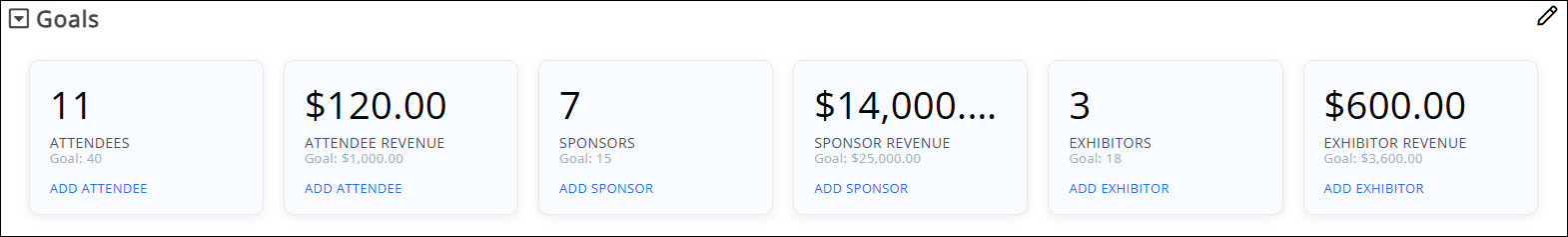

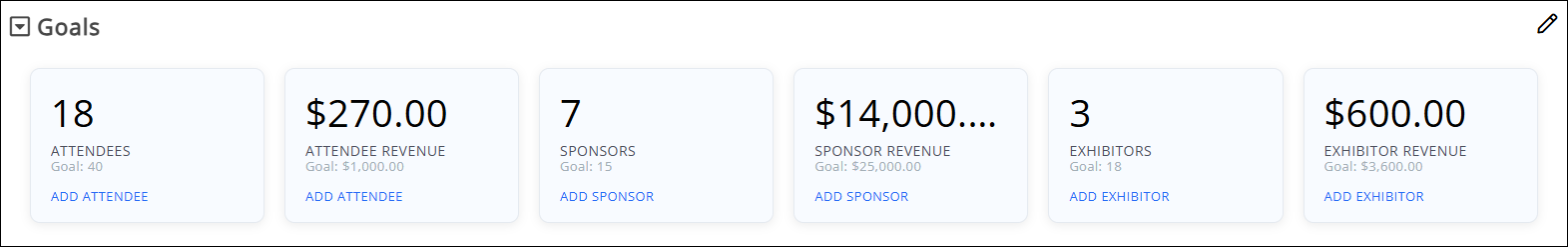

While the Goals section on the Overview tab displays numbers for an event that can be helpful, they can also be confusing if it is unclear what is included in this data or the purpose of the display. Questions also arise if the Overview totals do not match financial reports. Which is correct? What numbers should I look at to understand how much money my event made?

Event Revenue

General explanation: The Revenue amounts shown on the Overview tab give you a quick look at what you can expect from this event. Amounts come from the event registrations. These overview numbers are forecasted revenue (invoices) vs. collected revenue (payments).

To see collected revenue, which includes all the variety of transactions that may occur for an event, including refunds, write-offs, payments, and outstanding invoices, running the Transactions by Contact Report filtered to your specific Event Name is going to be the way to get all detailed financial information in one place. This report can also tell the story of your forecasted revenue too. For applied credits, you will need to run the Credit Memo Report (note: be sure to include the full name of the event in the Notes of any credit memos).

If the forecasted revenue in the Transactions by Contact Report does not match the event Overview forecasted revenue, then a reconciliation of what your events show for registrants vs. what your transactions show will be a good exercise. You wouldn’t want your books over/under stated nor would you want your event attendance list to have more/less people than are truly coming.

Best Practice: To ensure that both your financial and event information stay in sync, here is the general idea of how to work in your events.

- If a change must be made to the attendees, sponsors, exhibitors or their items, make those changes in the event module using the options available in the event i.e. Cancel registration, Update Registration etc.

- Then circle back and make any additional changes to the billing if required. For example, cancelling an unpaid registration automatically creates a write-off for you; no additional action is required. But if you cancel a paid registration, be sure to refund or credit the corresponding invoice. This will prevent discrepancies between your event totals and the financial transactions.

Details on Event Overview Totals

What should I expect to see in the Event Overview totals? Below is a general guideline.

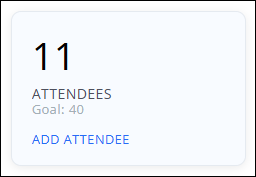

Attendees

Attendee Count includes:

- The quantity of attendees that are marked as Registered and Attended

- Attendees that are part of a table/team

- Attendees that are part of a sponsor or exhibitor registration

The quantity here should match the quantity on the bottom of the Attendees tab if using the default filters on that tab.

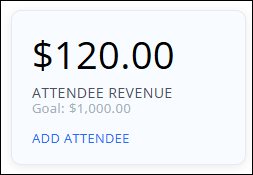

Attendee Revenue

In general, this is forecasted revenue; the amount that your event has INVOICED.

Attendee Revenue includes:

- Attendee registration amounts

- Additional Items set as "For Attendees" added to a registration

- Paid and Unpaid invoices

- Registered or Attended Status

Reductions include:

- Discounts are subtracted

- Cancelled registrations are subtracted

- Attendees that are included as part of a sponsor or exhibitor registration do not increase revenue here; additional purchased attendees would be included.

Does not include:

- Additional Items set as "For Overall Registration". Those amounts are included in the total on the Attendee Purchases tab and also as a line item on the Event Activity Report.

Matches:

- Revenue here should match the total shown on the Transactions by Contact Report, looking at the Line Item Totals column filtered to this event and to your Attendee Fee Items and to Invoice and Write-off Transactions only.

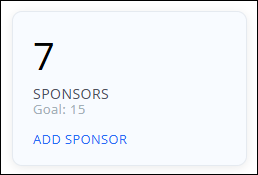

Sponsors

Sponsor Count includes:

- The quantity of sponsor registration types that have been registered for. It is not the count of unique sponsors.

- Registrations of both "Pending" and "Registered" status

- The quantity here should match the quantity on the bottom of the Sponsors tab if using the default filters on that tab.

Sponsor Revenue

Just like Attendee Revenue, this is forecasted revenue; the amount that your event has INVOICED.

Sponsor Revenue includes:

- Sponsor registration amounts

- Paid and Unpaid invoices

- Registrations of both "Pending" and "Registered" status

- Cancelled registrations are subtracted

Matches:

- Revenue here should match the total shown on the Transactions by Contact Report, looking at the Line Item Totals column filtered to this event and to your Sponsor Fee Items, and to Invoice and Write-off Transactions only.

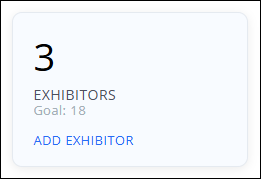

Exhibitors

Exhibitor Count includes:

- The quantity of exhibitor registration types that have been registered for. It is not the count of unique exhibitors.

- Registrations of "Registered" status

- The quantity here should match the quantity on the bottom of the Exhibitors tab if using the default filters on that tab.

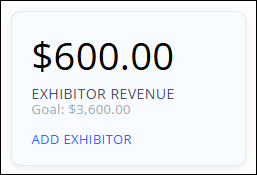

Exhibitors Revenue

Just like Attendee Revenue, this is forecasted revenue; the amount that your event has INVOICED.

Exhibitor Revenue includes:

- Exhibitor registration amounts

- Paid and Unpaid invoices

- Registrations of "Registered" status

- Discounts are subtracted

- Cancelled registrations are subtracted

Matches:

- Revenue here should match the total shown on the Transactions by Contact Report, looking at the Line Item Totals column filtered to this event and to your Exhibitor Fee Items, and to Invoice and Write-off Transactions only.

Financial Event Details

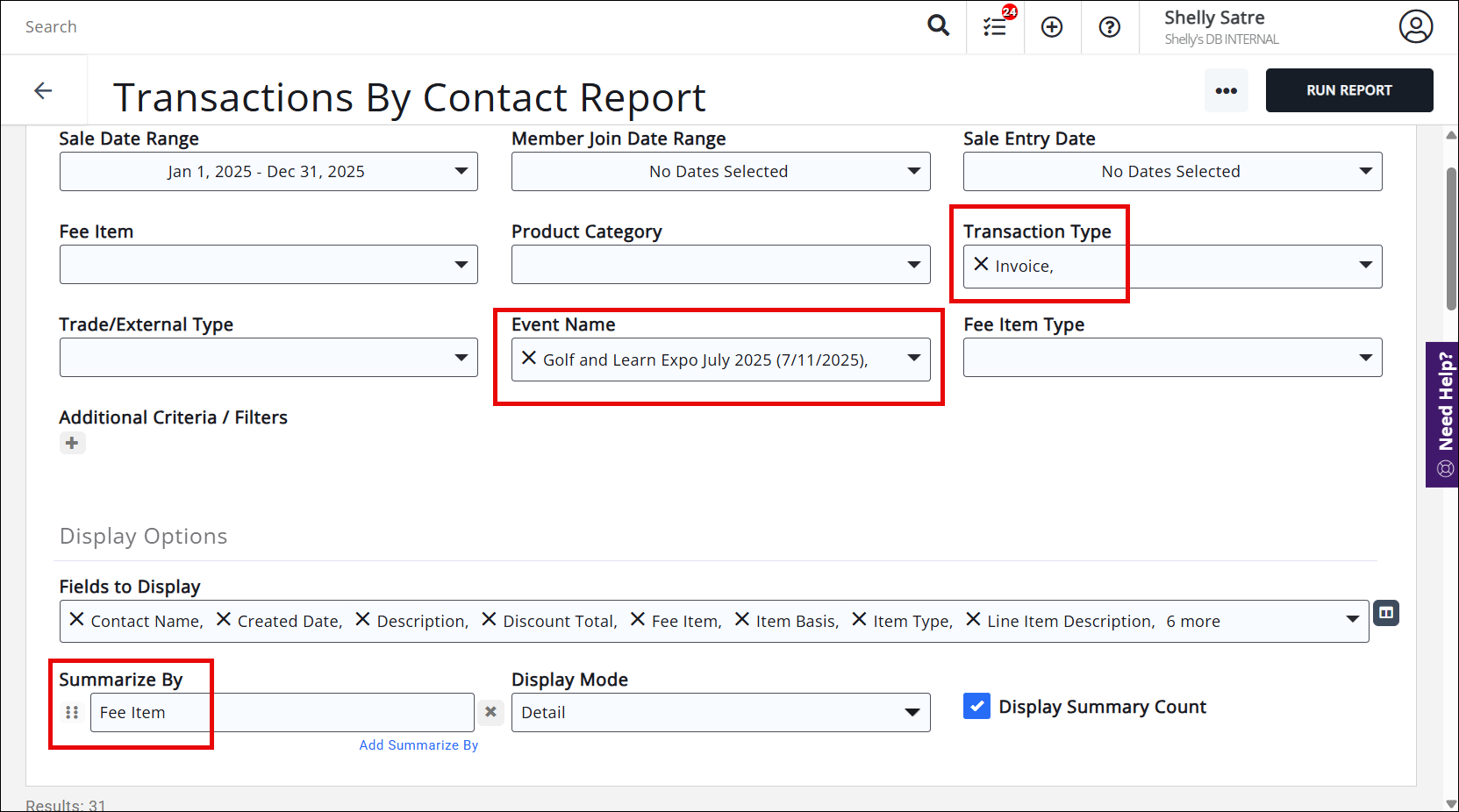

Overall, the best report available for you to customize is the Transactions by Contact Report. This report allows you to filter by event, which will allow you to fully review your event's revenue including additional items and chart of accounts information, as well as invoiced revenue vs collected (paid) revenue.

If you have issued or applied any credit memos for registrations (attendee, sponsors, or exhibitors) you can use the Credit Memo Report to view those. Best Practice: include the full name of the event in the Notes portion of the credit memo being issued. This will allow you to use that field as a filter for the report!

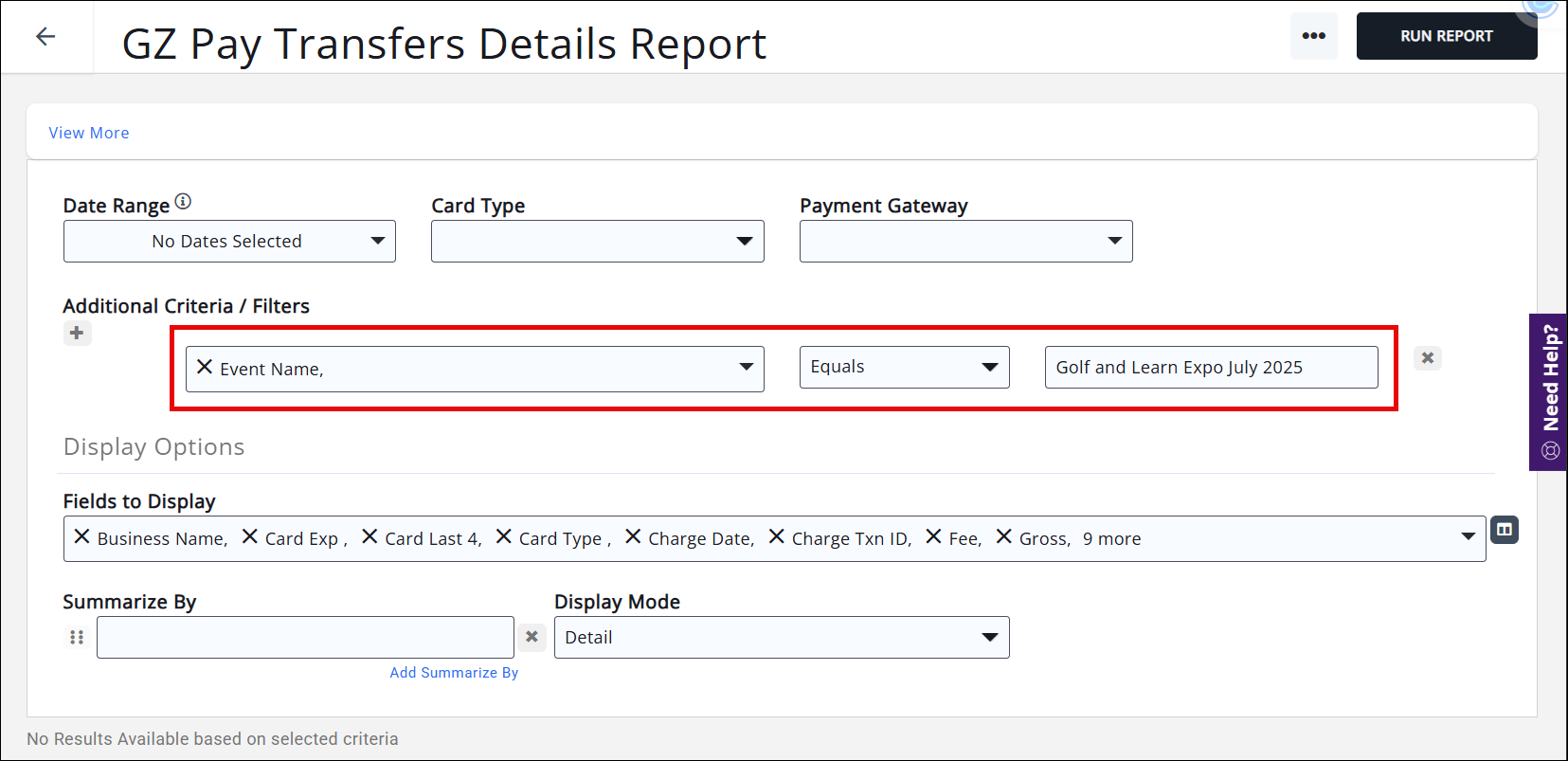

If credit card fees are a concern and you have a fully integrated GrowthZone Pay payment gateway, you can use the GZ Pay Transfer Details Report to find those fees for net revenue reporting. Include the Event Name, Invoice Number, Invoice Numbers in your Fields to Display, and filter the report to your Event Name. Look for the total on the Fee column to find the credit card fee amount associated with this event.

IMPORTANT! IMPORTANT! IMPORTANT!

Do not make an additional entry to your accounting software if you already address it in QBO when doing deposits or when doing the adjusting entry for a summary export to your accounting software.

If you have any other payment gateway (Authorize.net, NAR Ecommerce, or others) you will need to gather this info from that service provider outside of GrowthZone.

- Forecasted Event Revenue: This is the amount that your event has INVOICED. This will be a customized version of the Transactions by Contact Report.

- Collected Event Revenue: This is the amount that your event has RECEIVED in payments. This is a gross amount and does not include any credit card fees. This will be a customized version of the Transactions by Contact Report.

- Net Event Revenue: This is the amount that your event has CLEARED after subtracting credit card fees and refunds. We will find these amounts on the Transactions by Contact Report (refunds) and the GZ Pay Transfer Details Report (for credit card fees; GrowthZone Pay payment gateways only) and subtracting those amounts from the Collected Event Revenue total.

- NOTE: Not all write offs in an event are lost revenue; some may be corrections to incorrect registrations.

Scenario:

Our organization is holding a Golf and Learn Expo in July. Let's take a look at our overall event statistics as of today, March 26, and see what happens when we make some attendee registration adjustments.

Adjustments:

- Attendee Rusty Jones calls up and has to cancel his registration due to unforeseen circumstances, so we cancel his registration and issue a refund for the entire amount of his registration ($80). Part of his registration included an additional item (golf cart rental), for $50; the remaining $30 was the event registration.

- Attendee Count: Reduced to 17

- Attendee Revenue: reduced to $240 (does not include additional item revenue)

- Attendee Walter Butters originally registered for the Afternoon Golf option, but meant to register for the Morning Golf option. To correct this, we cancel his registration, issue a credit memo for his registration fee of $20 (our setup tracks event invoices under the business, so this would be added to the BUSINESS contact record and not Walter), re-register Walter for the Morning Golf option using the "Invoice Me" option, and then apply the credit to the new invoice. There is a remaining balance of $10 for an increased registration fee, so he then applies payment for that balance.

- Attendee Count: Stays at 17

- Attendee Revenue: Increased to $250 (removed $20 = $220, added $30 = $250)

We run the Transactions by Contact Report, filtered to Transaction Type = Invoice to gather forecasted revenue. We also use the Summarize By option to group our revenue by fee item, so we can easily see our totals for Sponsors, Exhibitors, Attendees, Additional Items, and even Session fees.

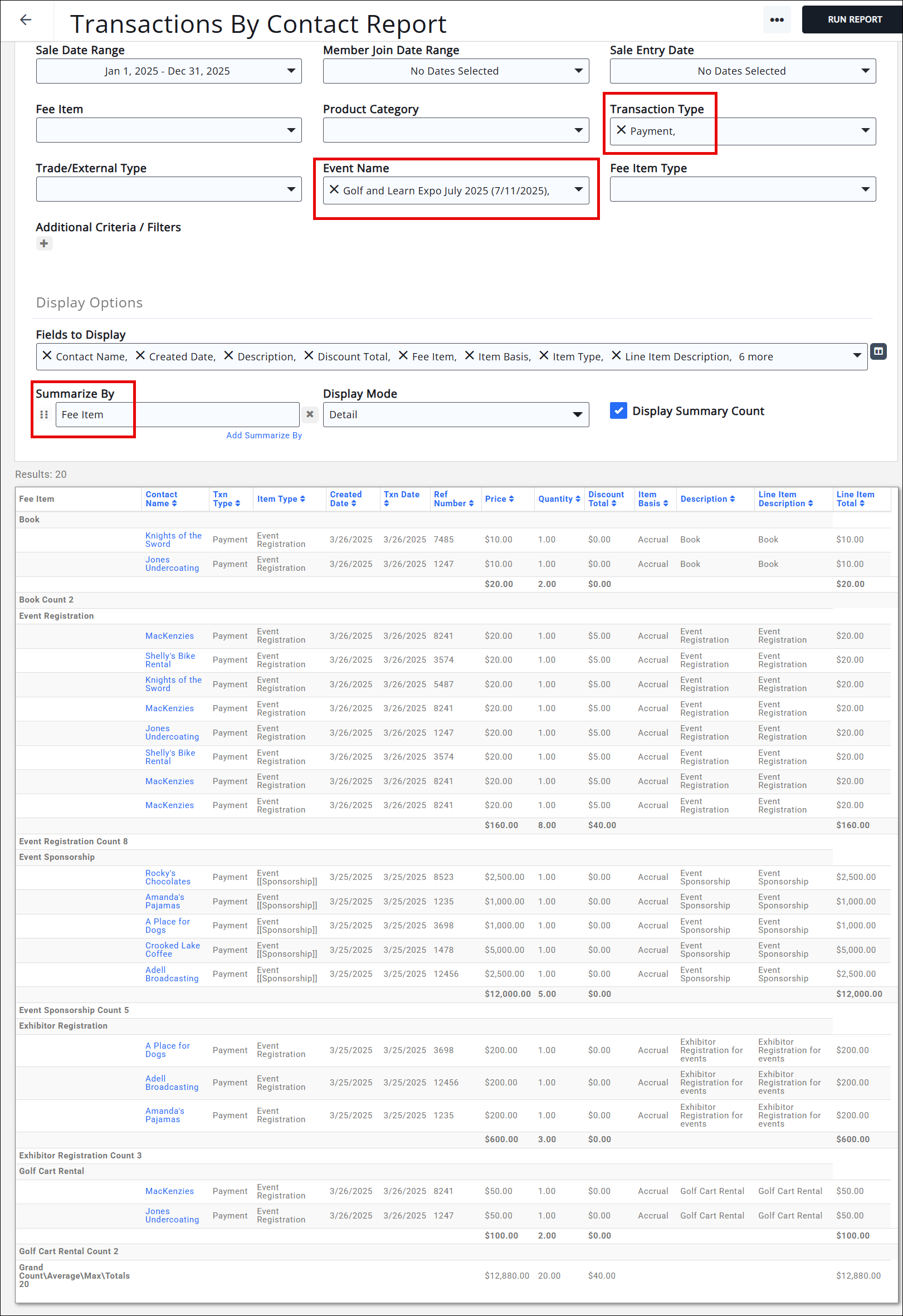

If we adjust the Report filter to account for Transaction Type = Payment, we can see the Collected Revenue amounts to $12,880.00- meaning we still have $2,170 in invoices that have yet to be paid.

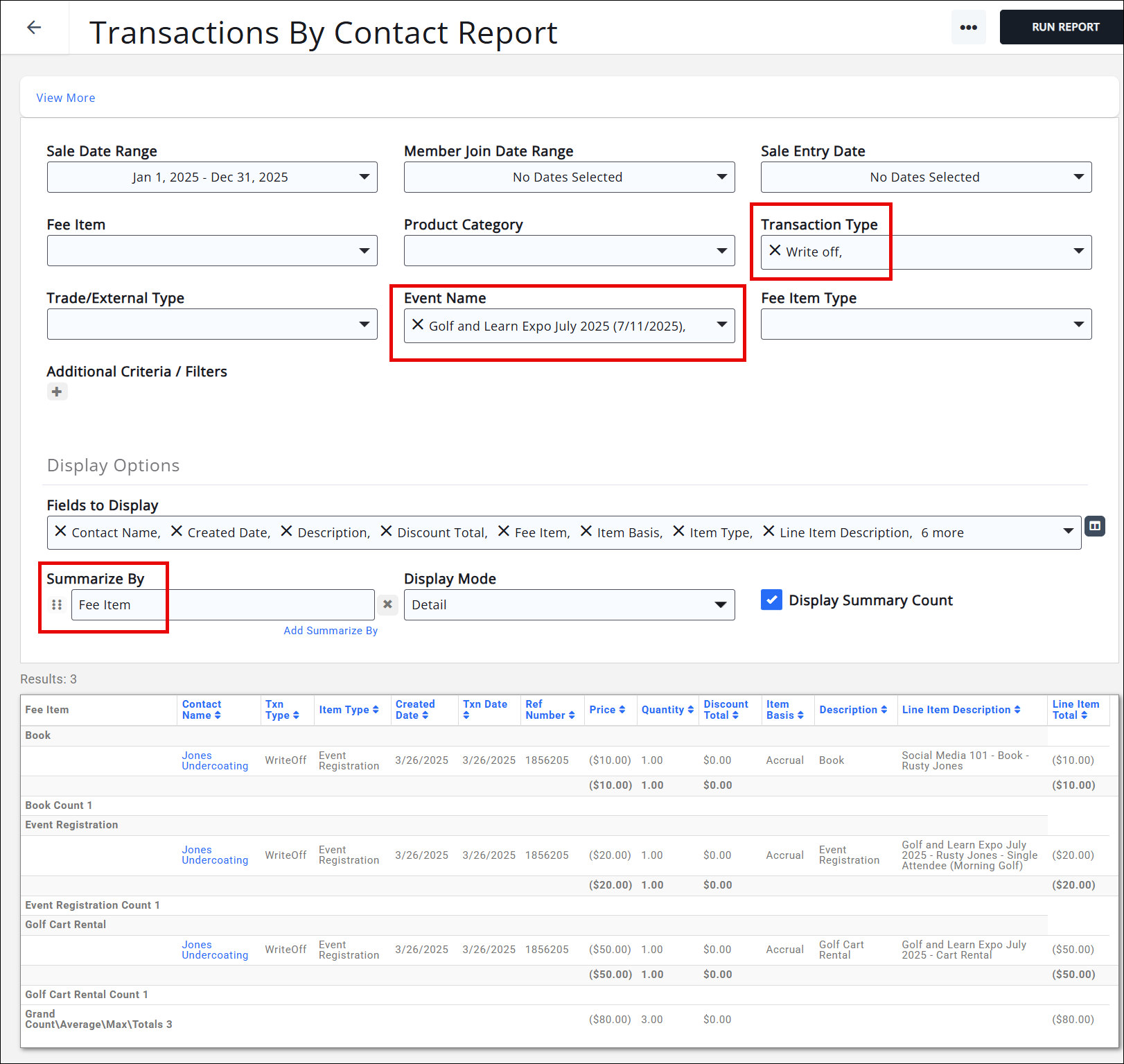

Now let's look at some of the "lost" revenue for the event. If we filter the Transactions by Contact Report to look for Transaction Type = Write Off, we will see the fee items from Rusty's cancelled registration.

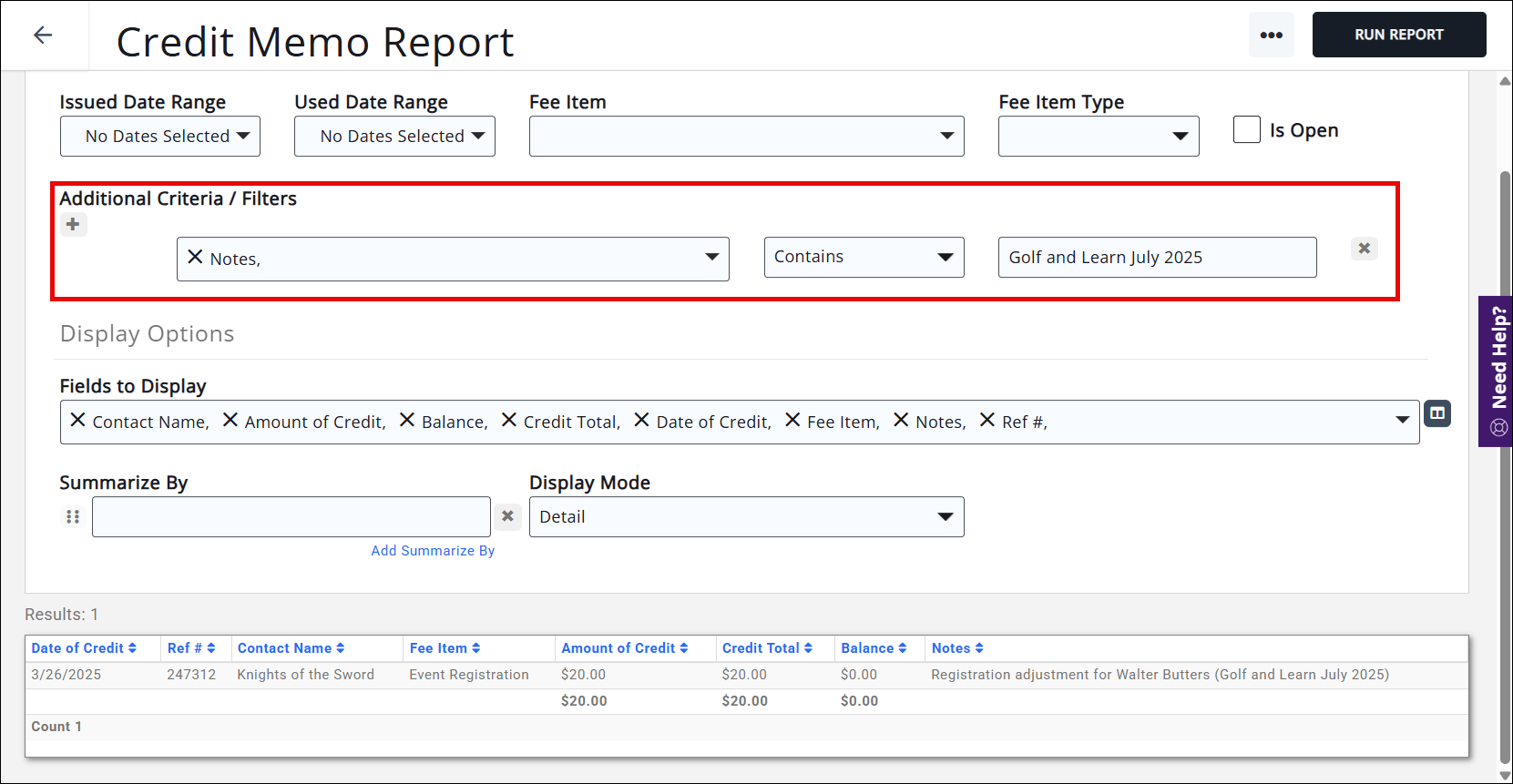

We don't see items from Walter's cancellation because he was issued a credit memo to "move" his payment from the original invoice to the new invoice without altering or voiding the original invoice. In order to see the credit that was applied for this event, we need to run the Credit Memo Report. In this case, I followed best practices and added the name of the event to the credit memo, so I can use that as a filter criteria to find any credits created/used from this event.

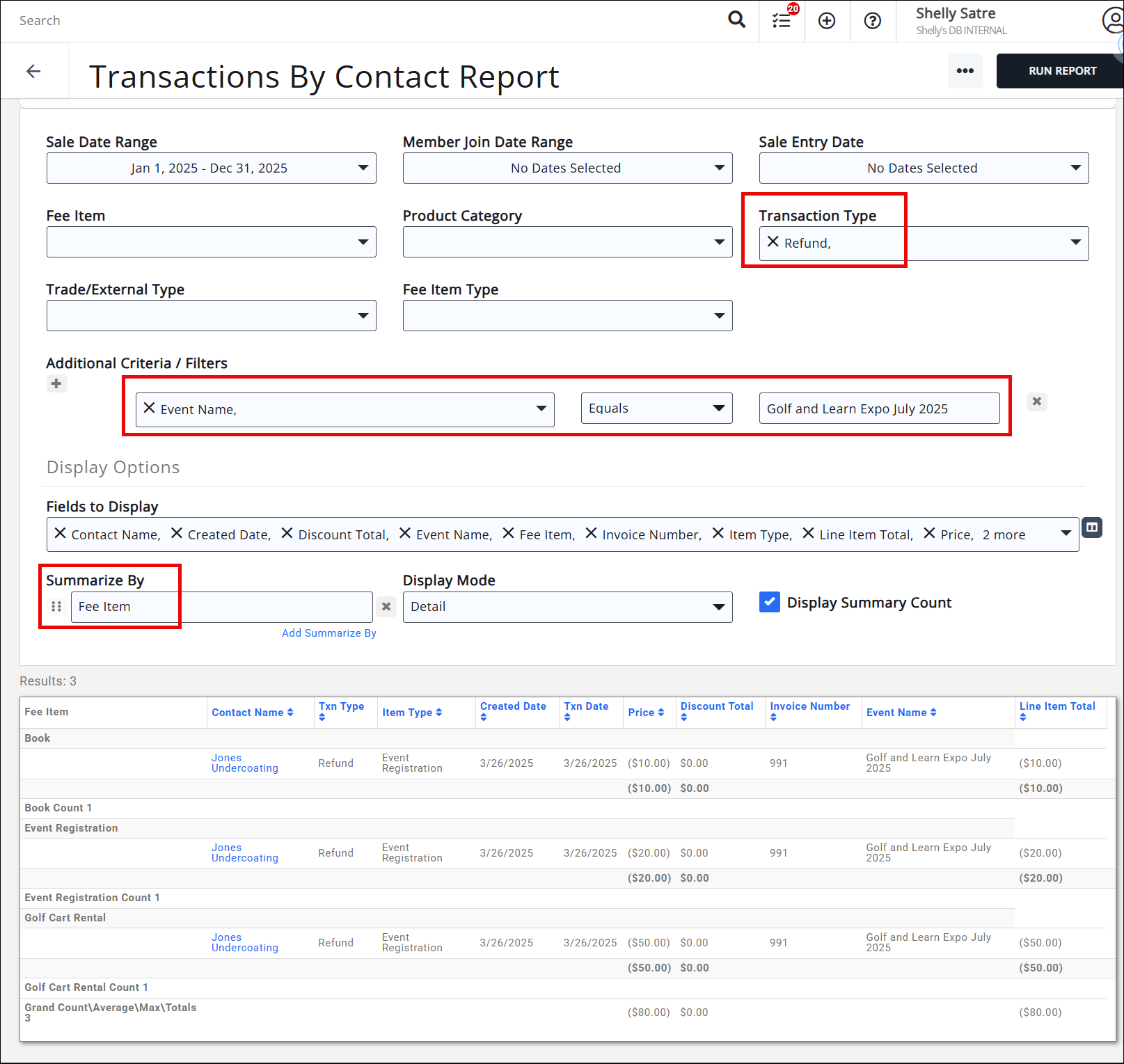

We can then run the report to see refunds; in this case, it matches our Write Offs as we only issued the one full refund to Rusty. These two reports may not always match, as refund amounts may not always match write off amounts (as would be the case for a partial refund).

If we had processed payments using GrowthZone Pay, we would then run the GZ Pay Transfers Details Report, filtered to the event name, to determine any credit card fees that need to be accounted for and subtracted from our overall total collected revenue. In my example I did not run any credit cards, so I do not have any fees to remove from my event collected revenue, but most event registrations are paid by credit card so this is an important step to include in your event reconciliation.

Recommendations

The following recommendations for event setup will make the reconciliation process easier:

- Use distinct fee items for attendee registrations, sponsor registrations, and exhibitor registrations.

- If using a single fee item for any/all registrations, having distinct descriptions will help in the reconciliation process by applying filtering options for "Description" in the report.

- If using Credit Memos to "transfer" payments from one registration type to another, include the full name of the event in the Notes section of the credit memo.

Tips to Find Discrepancies between Event Overview and Transactions by Contact

If your Event Overview totals don’t match your Transactions by Contacts Report forecasted total, there are a few typical things to look for.

• Did you make an adjustment to Registration Type Additional Items? See “Unable to Reconcile?” scenario below.

• Did you cancel a paid registration but forget to create the refund or credit?

• Did you void, credit, or refund an event invoice but forget to cancel the registration?

• Did you write-off a portion of a registration, but leave the registration as registered?

Unable to Reconcile?

Here’s a scenario that causes your event Overview Attendee Revenue number to be different than your comparable forecasted financial transactions:

- Quantities of Additional Items that are already paid cannot be adjusted in the event. Unlike attendees who can be cancelled, Additional Items cannot be removed or decreased if the invoice has already been paid. Due to this inability within the event, the only option is to make the adjustment via a financial transaction i.e. refund or credit. Because that adjustment cannot currently be done in the event, it will make your Attendee Revenue number on the Event Overview be inflated by that adjustment amount.

- Overall Additional Items are not part of any of the Event Overview totals, so the discrepancy between the Event Overview totals and your financial reports would only occur with Event Registration Additional Items if those items had been adjusted via financial transactions.